Any Bangladeshi citizen between the ages of 18 and 50 years can apply for the benefit of universal pension. You have to deposit money every month, this facility will not be available if you do not deposit money for a minimum of 10 years. After the age of 60, you will start getting a pension.

Considering the occupation and social status of the people, the government has initially announced four schemes. Schemes can be selected according to their location from these four schemes, Prabasti, Progress, Security and Equality.

The individual has to apply online for inclusion in the universal pension scheme. For this, a website called 'Upapension' (https://www.upension.gov.bd) has already been launched. Through this website, the opportunity has been created for anyone to be included in the pension program from Thursday (August 17).

How to get registered :

To be included in the Universal Pension Scheme, you have to register on the UPpension website. "If you apply with incorrect information, the application will be rejected and the deposited amount will not be refundable."

A certification page will appear first in the registration process; "I hereby certify that I am not working in any government, semi-government, autonomous or state-owned organization. We do not take benefits from any kind of government or autonomous organization outside the universal pension scheme. I don't take any kind of allowance under the social security program."

Click on the "I Agree" section at the bottom of this page to go to the second page to start the registration process. Here the applicant has to choose the applicable scheme from these four schemes – Expatriate, Equality, Security or Progress. At the same time, 10, 13 or 17 digit NID number, date of birth, mobile number, email ID should be written. Then write the captcha (a special security system used in information technology where you have to type a special text) at the bottom of the page and go to the next page.

After entering the captcha, an OTP or one-time secret number will appear in the applicant's mobile number and email, which will go to the next step with the form.

The next step in the registration process will be the personal information page. According to the NID of the person, NID number, photo, applicant's Bengali and English name, father's name, mother's name, current and permanent address will be automatically displayed (since this information has been given through NID number on the previous page).

However, here the applicant's annual income will be written and the name of the profession, own division, district and upazila will be selected. Professions like teachers, non-government employees, small businessmen, business, day laborers, lawyers, journalists, etc. are mentioned in the profession selection room. You have to choose your profession from there. Once all the text is done, go to the next 'Scheme Information' page.

When the scheme information page appears, you have to select the monthly subscription amount and the type of subscription payment. There are three options – monthly, quarterly and annually – in the type of subscription payment. Then you have to go to the bank information step.

On the bank information page, the applicant's bank account name and number, account type (savings or current), routing number, bank name (in Bengali) and bank branch name (in English) should be written. Then go to the next nominee information page.

Go to the nominee information page and add the nominee with the nominee's national identity card number and date of birth. Multiple nominees can be added here. At this time, go to the latest 'Complete Form' step with the nominee's mobile number, relationship with the nominee, the nominee's availability rate (if there is more than one nominee).

This is the last step of registration. In this step, the previously filled personal information, scheme information, bank information and nominee information will be shown. If there is a mistake, then go back to the beginning and make the necessary corrections to the information. And if all the information is correct, then the application process should be completed by agreeing to it. At this time, the applicant can also download the complete application.

Note that in the entire process of registration, you can not go back without completing all the page work. If you go backwards, you have to start all over again. However, in that case, the old information will be saved automatically; You don't have to rewrite.

Deposit Rate

To get a pension, you have to pay an uninterrupted subscription for 10 years. There is a difference in the rate of subscription deposit and the rate of receiving pension from scheme to scheme. In this case, a maximum of Tk 10,000 to a minimum of Tk 1,000 can be paid in a month. However, out of the Rs 1,000 subscription for the equality category, the individual will pay Rs 500 and another Rs 500 will be given by the government as grant.

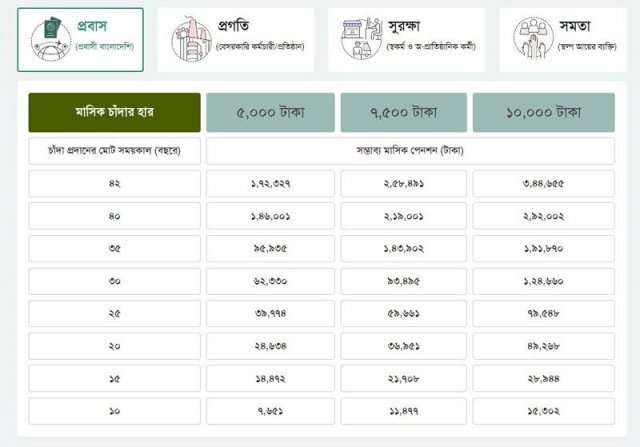

The longer the person subscribes under the Universal Pension Scheme, the higher the monthly pension will be paid. In this case, the maximum monthly pension of Tk 3 lakh 44 thousand 655 and the minimum pension of Tk 1,530 will be available depending on the scheme.

What are the four schemes

Of the four types of pension programs announced by the government, three types have been fixed in the Probas and Pragati schemes, four types in the protection scheme and one type of subscription in the equality scheme of citizens living below the poverty line. In each scheme, an equal amount of pension will be paid against the fixed contribution payable at the specified time. That is, if someone donates Tk 5,000 for 42 years under the expatriate, progress and protection scheme, then all of them will get a pension of Tk 1,72,327 per month.

In the expatriate scheme, 10,000, 7,500 and 5,000 subscriptions can be given per month. If an 18-year-old expatriate deposits Tk 10,000 a month in the expatriate program, then after 42 years (when he turns 60) he will get Tk 3,44,655 per month. If the expatriate pays 10 years at the same rate, he will get a monthly pension of Tk 15,302.

If an 18-year-old expatriate deposits Tk 5,000 a month in the expatriate program, then after 42 years (when he turns 60) he will get Tk 1,72,327 per month. If the expatriate pays the same rate for 10 years, he will get a monthly pension of Tk 7,651.https://cdn.banglatribune.net/contents/cache/images/640x0x1/uploads/media/2023/08/18/-bd883e228c52f4cdc4d625ae9126c7a9.jpg

Under the Pragati scheme (employees of private organizations), if an 18-year-old private employee deposits Rs 5,000 per month, he will get Rs 1,72,327 per month after 42 years. At the same rate, if you donate for 10 years, you will get a pension of Tk 7,651 per month.

https://cdn.banglatribune.net/contents/cache/images/640x0x1/uploads/media/2023/08/18/-d5e09c7de4c6b85ae5b4b8dd26243ec6.jpg

Under the protection scheme (self-employed citizens), if an 18-year-old person contributes Rs 5,000 per month to the pension, then at the end of 42 years, he will also get Tk 1,72,327 per month. At the same rate, if you donate for 10 years, you will get a pension of Tk 7,651 per month.

https://cdn.banglatribune.net/contents/cache/images/640x0x1/uploads/media/2023/08/18/-598b539639616a1ccc57d932f7c9c4cc.jpg

However, the government will pay half of the monthly subscription to the participants of the equality pension program for low-income people. In the equality programme, a participant will have to pay Rs 500 per month, while the government will pay another Rs 500. In this way, if a person deposits Tk 1,000 for 42 years, then he will get a monthly pension of Tk 34,465 at the end of the term. At the same rate, if you donate for 10 years, you will get a monthly pension of Tk 1,530.

According to the rules, the pension subscription has to be deposited in the bank account designated by the National Pension Authority. Deposits can be made through online banks, credit cards, debit cards, mobile financial service providers (MFS) institutions and any branch of scheduled banks.

What papers do you need?

To be included in the pension program, the person must have a National Identity Card (NID). However, those who do not have NID can be registered on the basis of passport temporarily. However, the NID will have to be submitted to the government as soon as possible. Those who are enjoying benefits under the social security program can also come under the pension if they want. However, in this case, they will have to exclude the benefits they enjoy under the social security program.

A Unique Identity Number (UID) will be given against each application. The registered mobile number of the applicant mentioned in the application and the UID number, subscription rate and monthly subscription date will be communicated through automated email in case of non-residents.

According to the rules, people above 50 years of age can also be included in any type of pension scheme under special consideration. However, what will be the pension program for people above 50 is yet to be finalized.

Meanwhile, the Finance Ministry said in a notification on Thursday that government employees can also be included in this pension scheme. However, it is not yet known what type of scheme they will be covered. Later, all the information including the pension scheme of the government employees will be informed through the publication of the gazette.

How much return for less deposit

The pension will be available at least 2.3 to 12.3 times the contribution payable in the universal pension scheme. The amount of pension depends mainly on the duration of the subscription. In this case, if you donate for 42 years, the pension will be at least 12.30 times the amount payable. On the other hand, if you donate for 10 years, it will be 2.30 times. That is, the longer the subscription is deposited, the higher the rate of pension. Apart from this, if the pensioner lives longer, the rate will increase further.

If a person pays subscription from 10 to 42 years, he will start getting monthly pension from the completion of 60 years of age. He will get a pension for life. If a person dies before attaining the age of 75 years during the pension period, his nominee or heirs will get pension for the remaining period. That is, they will continue to receive pension for as many months as they are left from the period of 75 years from the person's death. In this case, even if the pensioner dies, the government will have to continue paying pension for 15 years. As a result, it is clear that everyone will get a pension for at least 15 years.

At the rate of 10,000 per month, Tk 12 lakh will have to be donated in 10 years. On the contrary, if the pension is received for 15 years, its amount comes to Tk 27 lakh 54 thousand 360. Similarly, in the Rs 10,000 scheme, if you pay Rs 18 lakh in 15 years, the pension will be at least Rs 55,55,920 (2.89 times). In 20 years, the pension will come to 88 lakh 68 thousand 240 taka (3.70 times) by donating Tk 24 lakh. In 25 years, a pension of Tk 30 lakh will come to Tk 1 crore 43 lakh 2 thousand 240 (4.77 times). In 30 years, the pension will come to Tk 2 crore 24 lakh 38 thousand 800 (6.23 times) in a subscription of Tk 36 lakh. If you donate Tk 42 lakh in 35 years, the minimum pension will be Tk 3 crore 45 lakh 36 thousand 600 (8.22 times) and in 40 years, the pension will be Tk 5 crore 25 lakh 60 thousand 350 (10.95 times) with a subscription of Tk 48 lakh.

Apart from expatriates, pension will be available at the same rate as the amount and duration of the subscription of other schemes.